For financial services, balancing the skills, capacity, and workload of internal auditing teams is no easy feat, but best practice resource management can make all the difference.

In this blog post, we'll explore the unique resource management challenges faced by internal auditing teams in the financial sector. From preventing fatigue and errors to optimising recruitment, we'll share best practices to help teams work efficiently and deliver high-quality audits.

Let’s get into it.?

The integral role of internal auditing in financial services

In financial services, the internal audit function plays a pivotal role. It doesn't just monitor and evaluate the status quo but assures the board and senior management about the robustness and efficacy of these systems. No pressure!

Overseeing hundreds of audits annually, auditors ensure each process is swift, accurate, and aligned with stringent quality standards. Their responsibility is immense: ensuring the accuracy of operations, guaranteeing the authenticity of numbers, and keeping potential risks at bay.

But with so many moving parts, how can auditors guarantee nothing falls through the cracks? It's a daunting task for even the most seasoned pros. The answer lies in effective resource management tailored for internal auditing.

Understanding resource management in internal auditing

Financial services internal auditing requires a deep understanding of both the broader financial landscape and the details of individual audits.

So, what does resource management look like in this context?

?Human resources: The most significant asset for an auditing department isn't a tool or software; it's the people. Their expertise, capacity, availability, and experience form the foundation of effective auditing.

?Scope of audits: Senior auditors have a huge task. They must be acutely aware of the number of audits in the pipeline, the complexity of each, and the human resources required for their successful completion.

?Budgetary constraints: Auditing departments often operate within stringent budgets. Ensuring high-quality audits while adhering to financial constraints requires meticulous resource planning.

?Skillset and growth: An effective resource management strategy should not only account for the current skill set of its team but also identify areas of growth and development.

So, what challenges arise in this high-stakes game, and how can they be effectively managed? Let's explore…

The intricacies and challenges of resource management in auditing

Within this heavily regulated industry, auditors face unique and complicated challenges to mitigate the risks facing their organisations.

The most pressing challenges that auditors face today include:

?Monotony and precision: Auditing, by nature, involves repetition and meticulous attention to detail. Yet, routine can sometimes be the enemy of precision. The repetitive nature of the job can lead to complacency, making it easier for mistakes to creep in.

?Regular staff rotation: To combat the monotony and ensure fresh perspectives, senior auditors often rotate staff. However, this isn't a straightforward swap. The incoming personnel must have the right expertise and competency, to ensure continuity and consistency in the audit process.

?Evolving skill requirements: Gone are the days when auditors just needed a sharp eye and business acumen. The digital age demands a blend of traditional auditing skills with a tech-savvy approach. Moreover, as global work cultures shift towards flexibility, auditors now need to be adept at both in-person and remote auditing techniques.

?Continuous training and upskilling: In financial services new products, processes, and regulations emerge regularly. For auditors, this means their knowledge base and skill set must continually evolve. Ensuring that the auditing team is always at the cutting edge requires ongoing training and development.

?Flexible careers: Today's professionals seek growth based on skill and merit, not just tenure. This requires a more dynamic approach to career development within the auditing department, further complicating resource management.

?Embracing flexibility: Even in sectors like auditing, where onsite presence was once deemed essential, hybrid work models have become the norm. Adapting to this new model, while ensuring data security and process integrity, presents its own set of challenges.

Addressing these challenges is no small feat. However, by embracing best practices and leveraging the right tools, you can create opportunities for growth. Let’s delve into these best practices next.

Best practices for effective resource management in financial service auditing

In the high-stakes world of financial auditing, ensuring efficient resource management isn't just a matter of organisational success; it's vital for maintaining trust, ensuring compliance, and safeguarding reputations.

Let's explore some best practices:

1. Unified resource planning: Don't scatter resources across various platforms or spreadsheets. Use a single, centralised tool to manage all your resource planning. This holistic view ensures clarity, identifies resource gaps, and offers insights that drive effective decision-making.

2. Optimise resource utilisation: It's not just about having resources; it's about using them optimally. By actively monitoring resource utilisation rates, auditing departments can enhance efficiency, reduce downtime, and make informed staffing decisions.

3. Skills-based assignments: With a diverse skill set becoming increasingly important in auditing, it’s crucial to ensure that assignments align with individual skills. Using a robust skills database can help in matching the right auditors with the right projects, ensuring quality and efficiency.

4. Plan for capacity and recruitment: Gone are the days of hiring on a hunch. Leveraging data to understand your current team's capacity and identifying skill gaps ensures strategic recruitment. Hiring becomes a solution-driven process rather than a reactive one.

5. Agility in resource allocation: To combat job monotony and ensure fresh perspectives, it's essential to be agile in reallocating resources. Tools that allow dynamic resource shuffling without the hassle can be invaluable here.

6. Continued professional development: The world of finance doesn’t stand still, and neither should auditors. Investing in continuous professional development ensures that your team remains at the forefront of industry changes and is equipped with the latest tools and methodologies.

7. Feedback and communication: Effective resource management is a two-way street. Regular feedback sessions with the auditing team can provide valuable insights into potential improvements, concerns, and evolving needs.

8. Embrace technology: Whether it's AI-driven data analysis or advanced resource management software, staying updated with the latest technologies can provide a significant edge.

?See more: How to choose the best resource management software.

Incorporating these best practices won't just enhance the efficiency and effectiveness of the internal auditing function. It can also create a culture of continuous improvement, ensuring that the organisation remains resilient and adaptive in the face of future challenges.

In the next section, we'll delve deeper into how resource management software can be a game-changer for auditing departments.

Introducing resource management software for auditing

In an age where data drives decision-making and technology enhances productivity, it's no surprise that resource management software is becoming indispensable for internal auditing departments.

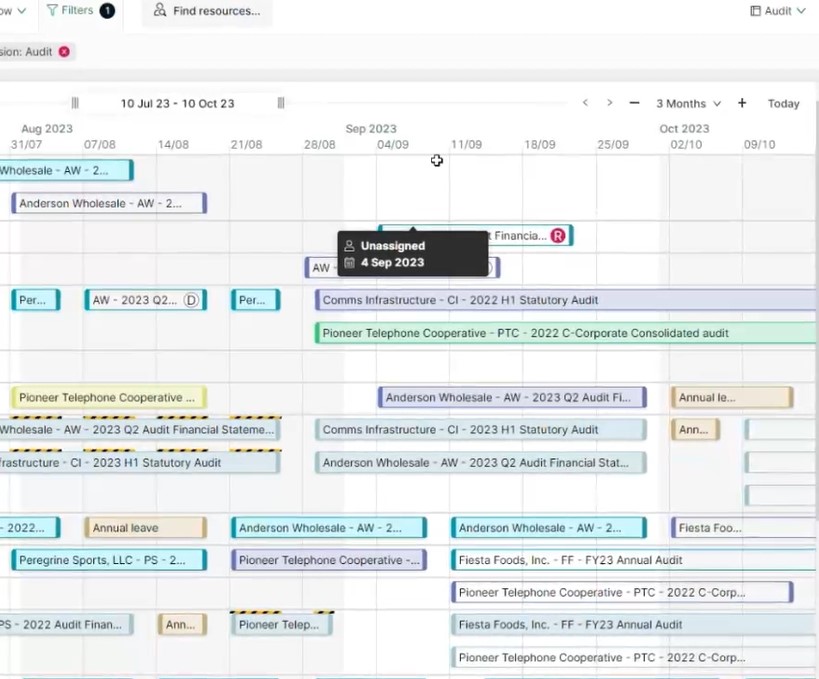

(Retain makes internal auditing resource management easy with skills matching, simple scheduling, utilisation tracking, and more.)

Let's look at why integrating software into your operations can redefine how you view, manage, and deploy your resources:

1. Comprehensive oversight: The right software can offer a consolidated view of all your resources – their availability, skill sets, ongoing tasks, and more. This type of overview simplifies allocation, identifies bottlenecks, and streamlines processes.

2. Skills and training tracking: Modern auditing isn't just about financial acumen; it's about technological know-how, adaptive thinking, and interdisciplinary expertise. Resource management software allows you to track the evolving skills of your team, highlighting areas for potential training and development.

3. Efficient workload distribution: By assessing real-time data on workloads and resource availability, such software ensures that no team member is overburdened or underutilised. This not only enhances job satisfaction but also ensures optimal productivity.

4. Data-driven recruitment: By identifying recurring skills gaps or frequently overburdened resources, these tools can provide actionable insights into recruitment needs. This ensures that hiring is proactive, targeted, and aligned with the department's strategic objectives.

5. Enhanced agility: The dynamic nature of auditing means that plans often change. Resource management software allows for quick reallocation and adjustment, ensuring that the auditing process remains on track, even when the unexpected occurs.

6. Cost efficiency: By optimising resource utilisation, minimising downtime, and aiding strategic recruitment, resource management software can contribute significantly to cost savings. To be clear on this, you can discover your ROI here.

7. Seamless integrations: Modern software solutions often integrate seamlessly with other tools and platforms, creating a cohesive tech ecosystem that further streamlines processes and enhances data accuracy.

Software solutions like Retain offer features tailored to the unique demands of auditing, ensuring that departments can navigate the complexities of the field with confidence and precision. So, whether you're looking to overhaul your current processes or simply fine-tune your operations, considering resource management software might just be the next step.

??If you’re ready for that next step, you can book a demo here.

The future of auditing with effective resource management

Resource management for internal auditing is not just a behind-the-scenes activity; it's the foundation of a proactive, effective, and resilient financial system.

Key takeaways:

?Human capital is king: In banking, our most invaluable assets are our people. Their skills, agility, and expertise determine the success of the audits.

?Embrace flexibility: The landscape of work is changing. Offering remote or hybrid working models and more diverse career paths can unlock unparalleled productivity.

?The power of technology: Tools like Retain International aren’t just about streamlining processes. They offer clarity, precision, and much-needed foresight in a rapidly evolving industry.

Internal auditing is filled with challenges, but also huge opportunities. That’s why financial services firms need not only the best minds but also the best tools. With the right resource management strategies in place, you can be fully prepared.

Learn more about how Retain can support your resource management needs.